If you want to be sure to reach your financial goals, you must start planning to do just that today. It can be a challenge to master your money, but if there is anything that can bring calmness into your life, it could be financial stability. Here are some ways that you can reach financial success by mastering your finances:

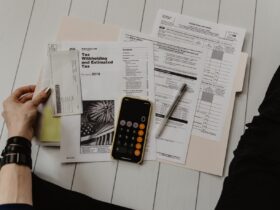

Learn how to do your taxes well

Tax payments and penalties can get you down, and dealing with IRS issues is never fun. This is a big reason why you should take care of your taxes just as well as you take care of your monthly budget. You may want to consider working with a tax professional if you’re clueless about how to do your taxes.

Or you could also think about online support like an Intuit Tax Advisor so that you’re always on top of your taxes.

Start a savings account

Savings really make a difference when you’re looking to improve your financial situation. A savings account can help you have the money that can make a difference when you want to make big life decisions like buying a home or moving to another country.

You may need to start small if you’ve never had a savings account before. It’s also a good idea to consider opening a savings account in a different bank than your checking account so that you can avoid transferring your savings whenever you feel a bit short on cash. You can also set up automatic transfers from your main account to your savings at regular intervals so that you’re always slowly but surely building up those savings.

Take stock of how you spend your money

If you have a habit of just spending money on a regular basis without really thinking about it, you may want to consider tracking your spending for a minute. Using expense tracking apps, you can see where you may be overspending money that could be much better set aside for savings or investments.

If you find that you’re regularly short on cash, it could be because you’re not keeping tabs on where your money is actually going. There are so many different kinds of subscriptions that you may be spending money on that you don’t even hardly use. Maybe you’re buying food and groceries on a whim instead of looking for ways to save on your shopping with coupons. Take time to look at how you spend your money, and you may become wealthier than you ever thought possible.

Consider working with a financial advisor

If you’re someone who has been building up a base of solid savings, a financial advisor can help you to manage your money so that you make the right choice regarding where to put that money you’ve worked hard for.

A financial advisor has the insight that can make a difference in where you decide to save and invest and help you hold back from financial decisions that could be a mistake in the long term. Ask acquaintances for recommendations as you want to be sure your financial advisor is someone that you can trust.

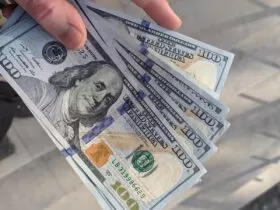

Invest your money

If you want to see your money grow and grow substantially, investing it in the right place can mean you make more money than you’ve ever thought possible. There are a number of ways to invest money, whether you want to invest in real estate or stocks and bonds.

While you can save all the money you want, without a way to increase those savings, you may find that you’re losing out on growing the kind of wealth that you’ve dreamed of.

In Conclusion

From saving your money to knowing how to manage expenses, there are many ways to take control of your finances and make sure you’re doing what you can to save more, invest more, and build up more wealth. Start looking for ways to do more with your money today!