As a complex and rapidly evolving field, it’s natural to have questions about the intricacies of crypto. Luckily, we’re here to provide answers to all of your crypto-related inquiries. Whether you’re a seasoned investor or just getting started, this article can provide you with the most accurate and up-to-date information available.

Here, we’ll explore the fundamentals of cryptocurrency, from storing and trading to mining, regulatory frameworks, and the market itself. So, let’s dive in and help you understand this fast-evolving and technologically dynamic world!

Exploring Crypto Trading Options

When you trade crypto, you enter a quickly evolving market that operates 24/7, independent from centralized oversight, offering opportunities and challenges. Some opportunities lie within volatile market swings; other obstacles come when navigating decentralized systems’ complex mechanisms – please see further the sections ‘Delving into Crypto Trading’ and ‘Spotting Crypto Scams.’ As this sector develops, we’re witnessing advanced tools integrating AI analytics onto platforms that empower traders with information for making more informed decisions.

Crypto Wallets

As traders explore digital currencies, one of the first concepts they encounter is a crypto wallet. At its core, a cryptocurrency wallet is an electronic tool that enables users to securely store, send, and receive cryptocurrency – think of it like digital bank accounts but holding cryptographic keys instead of traditional money.

A wallet typically contains public and private keys. Public keys are for sharing funds, and private keys allow the owner to spend or transfer digital assets safely and privately. As with all investments, security must remain top of mind. Although advances have occurred, such as implementing multi-signature protocols to enhance protection, there’s always a need to stay updated on best practices to ensure the safety of your assets. It’s wise to stay current regarding best practices, so your assets stay safe!

Decrypting Crypto Mining

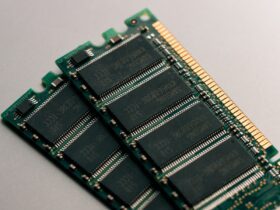

Crypto mining is how digital currencies like Bitcoin are retrieved for circulation. Mining involves solving complex mathematical problems using computational power to add blocks onto a blockchain ledger and earn newly minted coins as rewards for miners. Over time, the difficulty has increased, necessitating more powerful hardware. Mining pools were established where individuals combine resources to increase chances of earning rewards more frequently. Crypto mining is becoming an intriguing blend of technology and economics, continually adapting to the evolving landscape of the crypto world.

Spotting Crypto Scams

Unfortunately, cryptocurrency can’t escape malicious activities either. A common tactic scammers use is fake Initial Coin Offerings, where investors are lured in with promises of revolutionary cryptocurrency, only for them to disappear once enough funds have been raised by scammers. Therefore, it is crucial to stay informed and exercise due diligence by conducting proper research projects, being wary of unrealistically attractive promises, and using secure communication channels – both things the crypto community demonstrates so well in providing safe trading conditions ensuring traders operate safely within its ranks.

Navigating Crypto Taxes in the USA

Taxing crypto assets has undergone rapid transformation in the USA over the years. According to the Internal Revenue Service (IRS) classification of property as defined under capital gains taxes, any time cryptocurrency is sold, traded, or used as payment is likely subject to capital gains taxes. This is one reason to keep detailed records of your transactions to simplify tax processes. Although crypto taxation can initially seem complex, software solutions and tax professionals specialize in crypto so traders remain compliant while optimizing tax strategies effectively.

Understanding Crypto Liquidity Dynamics

Liquidity, a term borrowed from the traditional financial sector, also plays an essential role in crypto assets trading and valuation. Liquidity refers to how easily you can turn an asset into cash without impacting its price. High liquidity indicates an asset’s ability to be acquired or sold quickly without significant price changes between buy and sell transactions. Crypto liquidity is influenced by trading volume, number of active traders, and presence of market makers. As the crypto ecosystem matures, more decentralized exchanges and liquidity pools appear, altering the dynamics of traded and valued assets.

Development of Crypto Regulations

Authorities in the USA have long debated and examined the regulatory framework of digital currencies. Regulating bodies like the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) have played an active role in shaping this legal environment. The early days saw more laissez-faire regulation. However, recent years have improved and formalized explicit guidelines that aim to protect investors, prevent illicit activity, and integrate crypto more seamlessly into a comprehensive financial system. The goal is to ensure regulation while taking full advantage of the opportunities digital currencies present.

As regulations evolve, traders must keep up to speed to remain within legal confines while exploiting opportunities available as regulations change, ensuring legality while taking full advantage of opportunities. By staying up-to-date with changes, traders can capitalize on these opportunities while operating within legal parameters.

DeFi and Its Implications Have Seen Rapid Expansion Over the Last Five Years

Decentralized finance, more commonly called DeFi, represents an unprecedented transformation in finance. DeFi’s primary aim is to recreate traditional systems such as lending, borrowing, trading, and investing but without intermediaries by employing smart contracts on blockchain platforms. The promise of this is a more inclusive financial system with reduced fees and enhanced transparency. However, DeFi presents unique challenges as it scales. There are issues regarding security vulnerabilities with contracts since it is still at its nascent stage. Therefore, traders and investors must exercise extreme care before diving into it fully.

NFTs and Their Significance

Non-Fungible Tokens, or NFTs, have taken the digital world by storm since their debut as a novel way of representing ownership of unique items on blockchains such as Ethereum or Bitcoin. NFTs differ from cryptocurrencies due to being distinct entities that cannot be traded one-to-one. This has led them to be adopted across various industries, like art, music, and gaming, providing artists a platform to tokenize their work. At the same time, traders/collectors enjoy a new frontier of assets that blur tangible and digital value.

Future Trends in Crypto: Where Will it Head Next?

Predicting the path in crypto is like exploring uncharted territories. Still, specific trends are evident: integrating blockchain across sectors like supply chain management and healthcare proves that decentralized systems could become commonplace. Evolution in consensus mechanisms from energy-intensive proof-of-work towards greener alternatives like proof-of-stake also indicates this. As quantum computing becomes more accessible, crypto will adapt accordingly, ensuring security, scalability, and efficiency.